In recent research conducted by the Paulson Institute, it is clear that China is playing an increasing role in the expansion of “green” finance throughout the Middle East and North Africa (MENA). Using a combination of power politics, financing and infrastructure development, China is becoming a driving force in the region’s transition to green development, especially in clean energy.

It is no surprise that a number of MENA countries have aligned their sustainable development strategies with China’s Belt and Road Initiative (BRI) in order to leverage the expertise of Chinese firms as well as financing to promote green economic growth. But it remains to be seen how successful China will be in changing the behavior of these countries over the long term to become more sustainable.

Through targeted and strategic investments, China has been able to take a stake in many of the major renewable energy projects in the region. And more important, it has positioned Chinese companies, mostly state owned enterprises, to benefit as suppliers or developers of these projects as a condition of the financing that it provides to support these efforts.

One early investment by the Silk Road Fund, a government established fund to promote development along the Belt and Road, is the fund’s acquisition of a 49 percent stake in ACWA Renewable Energy Holding, the renewable energy arm of Saudi Arabia’s ACWA Power. The deal makes the fund a major shareholder in a portfolio of clean energy projects that adds up to a sizable 1668MW of generation capacity and provided access to projects across the MENA region.

It was not the first time ACWA Power and the Silk Road teamed up. Most notably, the parties teamed with Harbin Electric (a Chinese enterprise engaged in the research and development, manufacturing and construction of power plant equipment) to act as the project developer for the 2400MW Hassyan Clean Coal Power Plant in Dubai which has been under construction since 2016. It is the first clean coal power plant in the Gulf Cooperation Council region.

In addition to being part of the consortium acting as the project developer, Harbin Electric also acted as the engineering, procurement, and construction (EPC) contractor along with General Electric. Financing for the project was provided by the Industrial and Commercial Bank of China (ICBC), Bank of China, Agricultural Bank of China, China Construction Bank, and the Silk Road Fund. The groundbreaking project, which is the second biggest power plant under China’s BRI umbrella, shows how Chinese firms are involved throughout the value chain and not solely in the financing of these projects. Nonetheless, it is a major investment for the region.

China’s portfolio of clean energy projects in the region continues to expand. ACWA Power has a stake in some significant projects like the Noor Solar Power Station in Morocco, the world’s largest concentrated solar power plant, and the Mohammed bin Rashid Al Maktoum Solar Complex in the United Arab Emirates (UAE), one of the world’s largest renewable energy project based on an independent power producer model. Through their investment in ACWA Power, China now has a stake in these major projects.

More recently, in April 2019, Shanghai Electric Generation Group signed an EPC agreement for the DEWA (Dubai Electricity and Water Authority) 700MW concentrated solar project (CSP). The DEWA and ACWA Power, in collaboration with Shanghai Electric, will undertake the 700MW CSP portion of a 950MW solar project in Dubai. The ICBC is the mandated lead arranger and is aiming to approve a $1.5 billion loan. The project will allow the ICBC to support the three major Chinese power equipment suppliers — Shanghai Electric, Dongfang Electric, and Harbin Electric — in their efforts to expand globally. In addition to ICBC, Bank of China and Agricultural Bank of China will also play an important role in the financing of the project. The three will provide almost 80 percent of the debt and the total investment for the project is $3.87 billion.

China is now a growing power in the region’s renewable energy market, which has helped Chinese companies at a time when its own domestic market for renewables is growing through a restructuring. As MENA governments, including Saudi Arabia, Egypt, the UAE, and Qatar make diversification of their energy mix a core part of their economic growth strategy, China’s financing, design, procurement, construction, commissioning, hand over, and development services will continue to be in high demand. In fact, these projects are becoming a part of the BRI’s “North Africa Power Corridor,” which places great importance on the development of energy infrastructure in Egypt, Algeria, Tunisia, Morocco and Sudan.

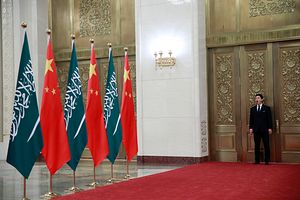

In addition, Saudi Arabian and Emirati leaderships have been actively recruiting Chinese participation in their own sustainability plans. Through this symbiotic relationship, Chinese companies have been able to establish a strong foothold in the region, and will play a crucial role in further developing these countries’ clean energy generation capacity. As an increasing source of carbon emissions and a region traditionally reluctant to move away from fossil fuels, China’s activities could have an important and significant impact on economic growth and lower pollution rates in the region.

Ossman Elnaggar is currently a senior at the Indiana University’s Kelley School of Business. He is a Paulson Institute Green Finance Center Research Intern where he is focusing on China’s sustainability drive in the MENA region.