Sri Lanka’s relationship with China has been a controversial discussion during the last decade, dominating both domestic and international political conversations. The strengthening relationship between the island nation and the emerging global power has been largely economic. Yet it is quite clear that Sri Lanka’s closest neighbor, India, and the United States are diligently monitoring these developments in the China-Sri Lanka relationship.

China has been a major economic partner for Sri Lanka. Beijing’s assistance has been crucial in saving the poorly performing Sri Lankan economy during the last three years. At the same time, Sri Lanka is compelled not to antagonize India, the closest neighbor of the island, with which Sri Lanka’s relationship runs deep and far back. The India-Sri Lanka relationship is vastly different than its ties with China.

With India, Sri Lanka’s relationship during the post-colonial era goes well beyond economic relations. India has been extremely influential in Sri Lanka’s domestic politics. For instance, India played a key role in introducing the 13th Amendment to the constitution of Sri Lanka, which brought power devolution to the country to provide a solution to Sri Lanka’s ethnic conflict. Concerns that ethnic conflict, particularly the problems of Tamil minorities living in Sri Lanka, are often amongst the political discussions in India, especially in Tamil Nadu. In 1987, India sent its army to fight against the domestic terrorist group LTTE, which demanded a separate country for Tamils in Sri Lanka. The mission is often considered a failure, and the then-Indian premier, Rajiv Gandhi, called back the Indian army given their failure to defeat the LTTE. Later, the LTTE killed Gandhi, claiming revenge for the operations against the LTTE. The war between the Sri Lankan government and the LTTE ended in 2009. However, the concerns about power devolution to the Tamil minority remain unaddressed and India has been consistently pushing Sri Lanka for full implementation of the 13th Amendment. Most recently, the same concern was raised by India’s External Affairs Minister S. Jaishankar during his visit to Sri Lanka in early 2021.

China’s relationship with Sri Lanka has been vastly different, due in part to China’s greater distance from the island. While China has been an ally of Sri Lanka in the post-independence period, its involvement in Sri Lanka’s domestic affairs has been minimal. The growth of the China-Sri Lanka relationship is a recent phenomenon and one largely anchored on economic and financial ties. However, in recent years, military and political relations between the two countries have also grown.

The Rise of Economic Relations With China

Upon upgrading to a middle-income country, Sri Lanka has been heavily exposed to severe and recurrent Balance of Payment (BOP) crises. This compelled successive governments to seek solutions to escape from economic troubles, which resulted in stronger economic ties with China – and an increased reliance on China in Sri Lanka’s development process.

While there are many vague claims about the strengthening economic relationship between Sri Lanka and China, which sometimes includes claims such as Sri Lanka becoming a cat’s-paw state for China, it is vital and essential to investigate the avenues through which bilateral economic relations have developed and the underlying reasons. While much discussion of the growing China-Sri Lanka relationship has focused on the increased reliance on Chinese loans, which is often (and inaccurately) depicted as Sri Lanka falling into a Chinese debt trap, growing bilateral economic relations go far beyond debt. The blooming China-Sri Lanka economic relationship, which Colombo seems to cherish as a blessing currently, is taking place through three main avenues: debt, investment, and trade. Therefore, restricting the focus of Sri Lanka’s reliance on China to merely Chinese loans downplays the growing relationship between the two countries.

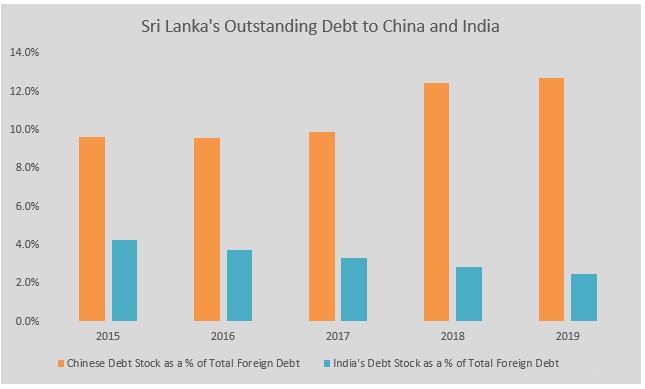

In terms of public debt, China over the last decade and a half has been the second-largest foreign lender for Sri Lanka. Several large infrastructure development projects, including the Colombo-Katunayake expressway, which connects the main commercial city and the major airport; Hambantota port; and the second international airport of the country, Mattala Airport, all were funded by Chinese loans. This of course has been a much-discussed phenomenon, used to strengthen claims of debt-trap diplomacy.

By the end of 2019, China owned a little over 10 percent of Sri Lanka’s outstanding foreign debt stock. While most of these debts consist of loans obtained for large-scale infrastructure development projects, recently obtained Chinese loans were for budgetary and BOP support. On top of that, in early 2021, the Sri Lankan government obtained a 10 billion renminbi (RMB) currency swap facility from China to tackle the ongoing foreign currency shortage. These indicate Sri Lanka’s changing relationship to Chinese Loans and increasing reliance on loan instruments such as Foreign Currency Term Financing Facilities and swaps to save the country from a severe Balance of Payment crisis, or even from defaulting on its debt.

Sri Lanka obtained a Foreign Currency Term Financing Facility (FTFF) of $1 billion from the China Development Bank in 2018, and another $500 million in March 2020. Most recently, in early April 2021, Sri Lanka signed another agreement with the CDB to obtain $500 million as an FTFF. These loan facilities, along with the currency swap provided in March 2021, indicate that Sri Lanka is heavily relying on China to avoid external sector vulnerabilities (i.e., BOP issues).

Secondly, similarly to Chinese lending, over the past decade, Chinese investments have also played a crucial role in Sri Lanka’s economic development. During the decade of 2010-2020, China has been the largest foreign investor in Sri Lanka. These investments include two controversial projects: the Colombo Port City Project and the investment in Hambantota Port by the China Merchants Port Company. Under the port city project, 116 hectares of reclaimed land in Colombo was leased to CHEC Colombo Port City (Pvt) Ltd, owned by a Chinese state-owned enterprise for 99 years. The port city project has drawn much controversy in the recent past. The opposition claims that proposed legislation intended to facilitate investment in the port city threatens Sri Lanka’s sovereignty.

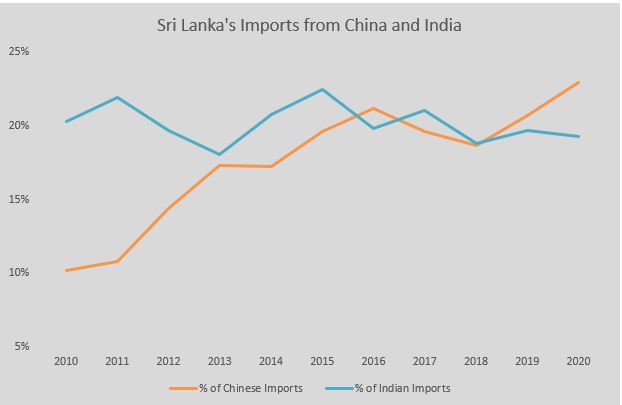

Third, during the last two years, China has become the top import partner of Sri Lanka, surpassing India, which had long been Sri Lanka’s largest source of imports. In 2020, China continued to be the largest goods exporter to Sri Lanka despite the heavy import restrictions imposed by the Sri Lankan government to control foreign currency outflows. This policy, however, does not seem to have affected China as much as it impacted India. Chinese imports were reduced by 8 percent in 2020, while in contrast, imports from India went down by approximately 19 percent.

The reason for is the type of goods imported from China. Over the years, China has become the major source from which Sri Lanka obtains raw material for textiles and garments. These, in turn, are the major merchandise exports for Sri Lanka; 45 percent of Sri Lankan exports are textiles and apparels. The availability of textile raw materials, such as yarn and fabric, at a low price from Chinese suppliers appears to be the major reason for Sri Lanka to import these goods from China instead of from India or Pakistan, which previously used to be major importers of textile materials to Sri Lanka.

India’s Economic Role in Sri Lanka

What is interesting to notice is how Sri Lanka’s economic relationship with India had progressed through these same three avenues: debt, investment and trade. India has never been a major lender for Sri Lanka, nor can they lend to Sri Lanka in a capacity similar to China. Unlike China, India runs on a trade deficit above $100 billion and runs into foreign exchange issues from time to time. This means India’s lending capacity is limited and their lending support will largely be based on export credits.

However, up until this year, Sri Lanka had been relying on India to manage its foreign exchange problems by obtaining currency swaps. Early this year, though, India refused to extend the term of its currency swap agreement with Sri Lanka, quoting concerns about Sri Lanka’s economic climate. New Delhi said it was unwilling to extend the swap facility unless Sri Lanka entered into an IMF program.

To many, however, this seemed like retaliation for Sri Lanka’s sudden reversal on a deal to lease a part of the East Container Terminal (ECT) of Colombo port to the Indian business conglomerate Adani group. Having promised earlier to lease out 51 percent of the ECT to India, amid rising opposition from nationalist groups, the Sri Lankan government abruptly reversed course, claiming they had decided not to lease the terminal.

This could be a concern for India for a few reasons. First, 85 percent of the Colombo International Container Terminal (CICT), which is the largest terminal of Colombo port, is controlled by the China Merchant Port Company, which operates as a joint venture with Sri Lanka Port Authority (SLPA). This deal was also inked under a Rajapaksa government, a few years back. Second, Hambantota port was leased to China for 99 years and the deal went ahead despite the controversies surrounding it. Against such a backdrop, India inevitably feels that they are being undermined or ignored in light of the growing presence of China.

However, Sri Lanka’s Cabinet has cleared the West Container Terminal (WCT) of Colombo port to be developed as a 35-year joint venture with India’s Adani Group and its local partner, John Keells Holdings PLC, as well as with an investment from Japan.

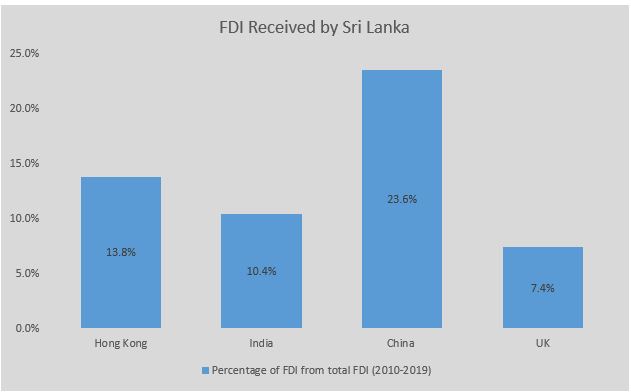

This brings us to the question of investment. Sri Lanka has received very little FDI from India and that number looks even smaller in comparison to the investment from China during the past decade. Additionally, the number of Chinese investments in Sri Lanka has been state-led and governed by strategic interests. The two best examples of such investment are Colombo Port City and Hambantota port, both of which serve strategic purposes for China. India, on the other hand, has made no such investments in Sri Lanka. Perhaps the only investment India has made that is of strategic interest is the Lanka Indian Oil Company, a subsidiary of state-owned Indian Oil Company, which controls approximately 15 percent of the auto fuel supply in Sri Lanka. This investment was facilitated in 2003 as a part of the then-government’s policy to break the state monopoly in fuel distribution. Since then there have been very little strategic FDI coming into Sri Lanka from India.

Trade has been the strongest part of the economic relationship between India and Sri Lanka. Historically, India has been Sri Lanka’s largest source of imports, until China surpassed India recently. The very first free trade agreement (FTA) of Sri Lanka was signed with India in 1998 and interestingly, the Indo-Sri Lanka Free Trade Agreement (ISFTA) was the very first FTA for India as well. This FTA has been in effect for a little over two decades now and there have been a few efforts to expand the FTA to an Economic and Technology Cooperation Agreement. However, these negotiations failed given the strong opposition of nationalist groups and professionals, as well as a regime change in Sri Lanka.

While there are issues regarding the Indo-Sri Lanka FTA, including concerns on non-tariff barriers imposed by India, more than 70 percent of Sri Lanka’s export to India are routed through the FTA, utilizing the tariff-free access. India on the other hand takes little advantage of the FTA benefits. As per existing data, only 10-20 percent of Indian exports are routed through the ISFTA to Sri Lanka. What is interesting to note is that China has overtaken India as the largest exporter to Sri Lanka without having an FTA with Sri Lanka, and thus without any tariff-free access.

China becoming the largest importer to Sri Lanka, including the major supplier of raw material to Sri Lanka’s textile industry, has significantly increased Sri Lanka’s reliance on China the trade front. This may have been seen as less of a concern compared to growing reliance on Chinese loans; however, the recent decision of Sri Lanka to obtain a 10 billion RMB credit swap from China was a clear indication of increasing Chinese influence tied to the rise of Chinese imports.

However, Sri Lanka’s exports to China have failed to match the growth of Chinese exports to Sri Lanka. In 2020, Sri Lanka’s exports to China amounted to just 2.3 percent of total exports, while exports to India represented 6.1 percent of total export. Sri Lanka relies more on India as an export market, especially as most of its products can enter India tariff-free, thanks to their FTA.

Balance of Power

Currently, the Sri Lankan economy is grappling with serious external sector issues. The country is struggling to meet its foreign debt repayments due to insufficient foreign currency inflows. With the COVID-19 pandemic, the situation worsened, largely due to the significant loss of tourism earnings, which constitute a major foreign currency inflow for Sri Lanka. On the other hand, Sri Lanka’s foreign debt repayment obligations remain the same.

Taken together, the circumstances have put Sri Lanka in a vulnerable position. The biggest concern is that Sri Lanka cannot address its problems as merely a domestic political issue. Tackling Sri Lanka’s external sector vulnerabilities, including the shortage of foreign currency, will require support from external parties, whether China, India, the United States, or even international organizations such as the IMF or World Bank.

Thus far, Sri Lanka has excessively relied on China to tackle its external sector vulnerabilities while economic relations with India seem to remain stagnant. At the same time, Sri Lanka tries not to irritate India. Against this backdrop, Sri Lanka is now struggling hard to balance between China, India, and domestic nationalists, all the while trying to save the country from a potential economic crisis. Thus far, it does not look easy.