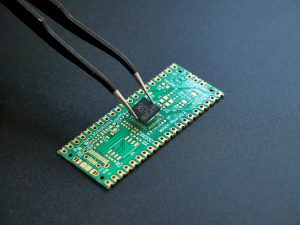

In October 2022, the United States imposed the most sweeping export controls on China to date. The rules seek to curtail China’s access to advanced semiconductor technology, including chips and the tools and expertise to make chips or to produce China’s own semiconductor manufacturing equipment (SME). The aim is to swiftly use U.S. leverage to blunt China’s supercomputing and artificial intelligence (AI) capabilities, based on the rationale that these enable China to develop advanced weapon systems like hypersonic missiles and surveillance infrastructure linked to human rights abuses.

The new controls significantly escalate China-U.S. tech competition. U.S. National Security Advisor Jake Sullivan has said his government wants to “maintain as large of a lead as possible” in AI and other “force-multiplying technologies.” Washington now treats China’s strategy of civil-military fusion and draconian surveillance programs, as well as advanced computing and semiconductor fabrication, as a threat to national security. Its protective measures are also inevitably hitting commercial technologies and industries in the United States and elsewhere.

But there is a risk. Some of these controls won’t be effective unless the other major semiconductor-producing nations get on board – which they have been reluctant to do so far.

Technology firms outside the United States want to continue doing business with China, and they could easily fill the void. Although the U.S. controls key chokepoints of semiconductor supply chains, it does not have the upper hand across all types of SME, which China has trouble producing domestically. Companies like Japan’s Tokyo Electron and the Netherlands’ Advanced Semiconductor Manufacturing International (ASMI) could start making the machines China needs within months.

In late October, after White House and Commerce Department officials visited The Hague and Tokyo to patch up differences, Bloomberg reported a trilateral deal may be in the works. But it has not been as easy for the United States to gain buy-in as some in Washington expected.

Allies perceived the unilateral export controls – after earlier, unfruitful conversations – as strong-arm tactics. The Biden administration’s underlying message was that Europe and Japan should get in line. One Japanese official reportedly called this a disregard for Japan’s sovereignty. The Dutch economy and trade ministers stressed their government’s intention to make its own deliberations. Still, these reactions were by no means a dismissal of the national security implications of China’s semiconductor advances.

Dutch lithography firm Advanced Semiconductor Materials Lithography (ASML) is at the center of the public debate over export controls in Europe. Best known for its extreme ultraviolet (EUV) lithography tools, which are subject to EU export controls in line with existing multilateral commitments under the Wassenaar Arrangement, ASML also produces most of the deep ultraviolet (DUV) lithography machines needed to make bigger chips.

Since summer 2022, U.S. officials have lobbied Dutch counterparts to also bar DUV exports, not currently subject to controls. China’s Semiconductor Manufacturing International Co. (SMIC) showed that they did not need EUV to produce chips below 10 nm. Instead, they used multi-patterning DUV, which is more resource-intensive. While this process is very difficult to scale, U.S. fears of DUV being used for such small chips by China were confirmed.

The Long Arm of U.S. Regulators

The new export controls initially triggered much confusion regarding the scope of an existing rule – the Foreign Direct Product (FDP) rule, which applies export controls to some products made abroad. Because U.S. technology is virtually everywhere across semiconductor supply chains, the United States has the power to authorize or block sales extraterritorially. In fact, these do not cover SME, thus initially sparing ASML’s machines from US long-arm jurisdiction. Going down that path could hurt U.S. interests, as it would severely erode trust among allies. The point is that Washington could use its leverage if it wished.

The trust problem is not new. Although economic considerations do not have a place in U.S. export control statutes, Washington’s growing intervention in global technology trade has raised concerns about protectionism. U.S. producers of wafer fabrication equipment (WFE) have until now made huge profits in China’s market, as others have pointed out. Meanwhile, some European firms felt the Commerce Department’s Bureau of Industry and Security (BIS) granted their licenses less readily than U.S. competitors’ licenses in the past.

ASML CEO Peter Wennink has complained that Washington favors U.S. SME players – with the proof being its heavy lobbying of the Dutch government in recent years that led it to reject licenses for EUV exports to China. U.S. companies have indeed expanded their China business significantly in recent years. Arguably, the de facto export ban on EUV was not all bad news for ASML. Many of the blocked EUV sales were probably replaced by additional DUV systems, since multi-patterning processes mean companies need more DUV machines to produce the same number of chips. Nevertheless, the complaints show an erosion of trust and the perception of U.S. protectionism.

Export controls especially burden companies when they apply extraterritorially. And European firms have been deeply unsettled about how the new U.S. rules would apply to them. ASML first clarified that the rules did not cover DUV, but still had to pull all its U.S. staff from China-related projects to comply. ASMI has said in investor presentations that it expects 40 percent of its China sales to be affected, though recent data suggests this is closer to 15-20 percent. Industry representatives also say that ascertaining the end-user and end-use of equipment and chip sales creates a large regulatory compliance burden.

Governments are in a tough spot, as they must ensure such export controls don’t kill their domestic industries. For example, unilateral European or Dutch controls without Japanese buy-in would give Japanese competitors an advantage. There are already signs that Chinese firms may be switching to Japanese SME makers, because these use less U.S. technology and are thus less likely to succumb to a future FDP rule covering SME.

Unlike SME, new U.S. export restrictions do apply the FDP rule to graphics processing units (GPUs). Due to this, British start-up Graphcore will likely not export its GPUs to China. And Britain-based, Japanese-owned ARM, which holds the chip design architecture used in most smartphones, announced it won’t pursue licensing of its most powerful designs to Alibaba or other Chinese companies because it expects the licenses to be denied. Chinese tech companies are highly dependent on ARM.

In response, China set up a new consortium of companies and research institutes that includes big tech companies Alibaba and Tencent and is tasked with creating Risc-V-based chip designs. Because it is open source, Risc-V doesn’t fall under Western export restrictions.

Revenues from China are key for many semiconductor companies. China accounted for 34 percent of ASML’s equipment sales in the first quarter of 2022. Even before the new controls, ASML had warned about possible disruptions to the supply chain. The company has a waiting list of buyers outside China, so alternative sources of demand could make up for the losses. However, European companies argue that without revenues from China, funding research and development will be a challenge.

South Korea, which is not strong in equipment but is home to leading chip producers, is also caught in the middle. In 2020, 43 percent of South Korea’s chip exports went to China. Like Taiwan Semiconductor Manufacturing Company (TSMC), South Korea’s Samsung and SK Hynix got a one-year grace period from the BIS to use U.S. technology at their facilities in China.

Contain China or Choke Business?

While Europe is uneasy about China’s technological ambitions – due to Beijing’s economic mercantilism and the strategic vulnerabilities posed by its central role in critical supply chains like semiconductors – there is little consensus between governments and companies on what should be done. In recent years, China has become one of the main growth markets for chip and downstream industries like EVs. Many European companies are doubling down on China, onshoring their supply chains there, while others are diversifying, but not reducing, their China footprint.

Although the United States is nudging partners to reduce their reliance on China – in chip and other areas like EV batteries – European companies worry about the cost of deglobalization. The chip supply chain is efficient because it is global and integrated. If supply chains splinter and more and more countries pursue policies aimed at self-reliance, the cost of chips will rise. European industry needs more and more chips, not only in high-tech sectors but also in low-tech areas like automotive that are being transformed by automation and digitalization. The 2020-21 chip shortage is estimated to have cost carmakers 100 billion euros ($100 billion). Like the United States, the European Union is now betting on industrial policy, primarily through its proposed European Chips Act, to revitalize its semiconductor industry and to manufacture 20 percent of the world’s chips by 2030.

However, the pursuit of a completely self-sufficient supply chain is not realistic. This assumes that efforts to boost resilience and diversification will make Europe more willing to accept restrictions on semiconductor business with China. And this only works if like-minded democracies coordinate to offset the costs of partial decoupling from China – through “friend-shoring” among allies. Despite pledges for transatlantic cooperation by the Trade and Technology Council, this concept still has a long way to go.

In fact, it is industry that is taking the initiative in securing and strengthening supply chains. With its planned investment in Taiwan, in fact, ASML may even help strengthen the island’s so-called “silicon shield” against a potential Chinese invasion, something the European Parliament is lobbying EU governments to do.

In the short term, European companies are concerned about China’s response to export controls. China has identified the need to produce equipment and chips domestically and is moving toward self-sufficiency in many areas, with mixed success. The U.S. restrictions have inspired a massive subsidy scheme of 1 trillion yuan ($143 billion), aimed at incentivizing the purchase of domestic chip-making equipment. This could hurt Europe’s industrial competitiveness.

Cutting China off from producing cutting-edge chips has pushed Chinese companies to stockpile older node technologies. U.S. export restrictions only target high-end chips and equipment, but the most common semiconductor process today is an older one, in which European companies lead the market. Their market shares could decrease if Chinese players flood the market with subsidized chips.

European corporates and policymakers also likely worry about Chinese government retaliation. Beijing has so far not taken any additional retaliatory measures in response to the U.S. export controls, but it did launch a lawsuit at the World Trade Organization (WTO). The suit is not expected to succeed, as U.S. officials claim WTO regulations don’t apply when national security is at stake. The United States has also thwarted any appeal by blocking the appointment of additional judges to the WTO Appellate Body.

But China does have several options for retaliatory measures. This includes using its dominance in key rare earth elements essential to the microelectronics industry. Beijing may also choose to frustrate mergers in the semiconductor industry, as it did in the past, or to use its new arsenal of long-arm legislation. Boycotting U.S. and EU companies would be another possibility, although the experience of Taiwan shows semiconductors are an unlikely target in the short term.

The Future of Multilateral Export Controls

The approach outlined by Sullivan, the U.S. national security advisor, raises questions about the future of export controls, which have traditionally focused on military or dual-use technologies. The swift allied response to Russia’s invasion of Ukraine has created momentum for a new arrangement to deal with emerging technologies like AI and China’s policies, as some analysts have advocated. The European Commission has included “strategic export controls” in its 2023 work program and has been discussing the implications of emerging dual-use technologies for export controls in fields such as advanced computing and semiconductors with a group of member states.

Yet, this will require time and political will. And political will can vary greatly across European capitals, as seen with Germany’s approvals of dual-use exports to Russia after Moscow’s annexation of Crimea in 2014. Capability-based controls, as leading U.S. export control expert Kevin Wolf calls the new U.S. approach, implemented to prevent China from obtaining a broad swathe of commercially available items, requires a mindset shift in The Hague and other capitals. While sharing some of the U.S. assessment of China’s threat, many European allies do not see Beijing as a strategic rival and are not on board with technological containment, despite the Biden administration’s reluctance to call it such. Enforcement is also a challenge for many EU member states as export controls gain complexity.

These challenges should not stop Europe from taking Beijing’s growing use of civilian AI innovation for military and surveillance purposes seriously. As the Biden administration mulls an expansion of China-focused export controls to areas such as quantum technology and biotech, expect the clash between Europe’s lack of resolve and Washington’s impatience to intensify. On the Chinese side, a more intense drive for self-reliance and the reorientation of all science and technology to national interests will further fuel this tech conflict.