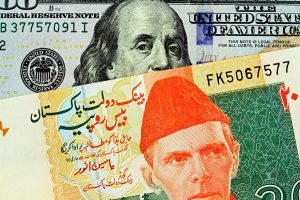

After months of delays and uncertainty, Pakistan and the International Monetary Fund (IMF) have finally reached a crucial $3 billion bailout deal.

This last-minute Stand-By Arrangement (SBA) agreement, which unlocks more than the expected $1.1 billion before the expiry of a ninth review on June 30, comes as a much-needed respite for Pakistan, which was on the brink of default. The news has been met with jubilation by investors and financial markets, leading to a significant strengthening of the Pakistani currency against the U.S. dollar and a historic surge in the country’s stock exchange.

The deal with the IMF not only provides immediate financial relief but also offers Pakistan an economic roadmap for the next nine months. This timeframe covers three quarters, including the period of a caretaker government ahead of elections. With IMF assurance, Pakistan can now navigate through this critical period with more stability and confidence.

With this deal in place, it seems Pakistan realizes the need to focus on implementing structural reforms that will strengthen its economy in the long run. In a display of commitment to the IMF framework, Pakistan last week introduced additional taxes, cut spending in its development budget, and hiked its key interest rate to a new record.

The IMF’s involvement also brings credibility to Pakistan’s economic policies, making it more attractive for foreign investors. The IMF funding is expected to unlock “another $3 billion in loans pledged by Saudi Arabia and the UAE,” according to a Bloomberg report. “Together, the loans should allow the country to repay its debts through April 2024, assuming that the current account deficit for the fiscal year comes in below $4 billion as the central bank projects,” it said.

Amid varied economic challenges, Pakistan finds itself on the edge even after securing an IMF deal. The country’s future hinges on its ability to avoid policy errors and stay committed to the fiscal course agreed upon with the IMF. With a staggering $24 billion debt payment looming this year, excluding import bills, Pakistan cannot afford to deviate from its financial obligations to international lenders.

Moreover, political developments in the country will play a crucial role in shaping the sentiment of both the IMF and investors in the coming weeks. With elections looming, there is a risk of politicians forgetting their commitments to the IMF, which could worsen the situation in ways the new government will find hard to cope with.

Looking ahead, Pakistan may require a larger IMF loan for an extended period after the elections. However, this possibility can only materialize if Islamabad successfully fulfills its current agreement with the IMF. In the coming weeks, there will be no room for the government to allocate funds for election campaigns or offer generous development budgets. It is also imperative that political stability prevails in the country to ensure that Pakistan can effectively navigate its financial challenges without any disruptions or setbacks.

The stakes are high, and any missteps could have severe consequences for Pakistan’s economy. As elections loom, political parties must come together and agree to a charter for the economy. This agreement will not only showcase their commitment to the IMF program but also demonstrate their dedication to honoring their commitments with international lenders.

Months of negotiations have been spent on convincing the IMF that Pakistan will fulfill its obligations, and now is not the time to deviate from the agreed-upon deal. Failure to do so would not only create a new wave of trust deficit between Pakistan and the IMF but also risk damaging relationships with other bilateral and multilateral lenders. Political parties must prioritize the country’s economic stability and work together towards a common goal.

Policymakers must remain steadfast in their commitment to financial discipline and prudent decision-making. By adhering to the agreed-upon fiscal course, Pakistan can pave the way for stability and sustainable growth in these challenging times.