On September 18, the Liaoning aircraft carrier of China’s People’s Liberation Army Navy (PLAN) passed through the waters between Japan’s Yonaguni Island and Iriomote Island, drawing significant attention from various governments and media outlets. This maneuver represents the latest step in China’s recent series of provocations against Japan, following incidents involving PLA aircraft entering Japanese airspace and spy ships intruding into Japan’s territorial waters.

While the strategic value of the Liaoning itself and the political implications of this voyage are undoubtedly important, three significant military trends related to Yonaguni Island have long been overlooked by observers.

Chinese Navy’s Increased Use of the Yonaguni Channel

The first trend concerns the activities of China’s military in the waters surrounding Yonaguni Island. In the past, the PLAN primarily traversed the Miyako Strait to enter the Philippine Sea. However, in recent years, it has increasingly expanded its operations to pass through the waters near Japan’s Yonaguni Island, significantly increasing the frequency of passages through the Yonaguni Channel, which connects the area west of Yonaguni Island with Yilan in eastern Taiwan.

According to a press release from the Joint Staff of Japan’s Ministry of Defense, from 2018 to 2023, PLAN vessels passing through the Miyako Strait accounted for between 54.8 percent and 100 percent of all Chinese navy passages through the waters between Japan’s southwestern islands. However, as of August 31, only 43 percent of PLAN vessels have passed through the Miyako Strait this year. Meanwhile, the percentage of PLAN vessels passing through the Yonaguni Channel to the west of Yonaguni Island and the waters to the east has steadily increased from 0 percent before 2020 to 26.6 percent this year.

More importantly, the number of passages through the Yonaguni Channel between Taiwan and Japan’s Yonaguni Island has increased from zero in 2020 to 18 this year, making up 22.8 percent of all PLAN transits in 2024 – a 10-point increase from last year.

A closer analysis reveals that all 18 vessels passing through this area this year were major naval combat ships, such as destroyers and frigates. In previous years, the vessels passing through included non-combat ships like intelligence-gathering vessels.

The Chinese government is well aware of Japan’s efforts to enhance its electronic warfare and technological reconnaissance capabilities in the southwestern islands. The increase in frequency of PLAN passages through this region despite the risk of electronic signal detection suggests that China may have designated the Yonaguni Channel as a critical area for operational training. This indicates that destroyers and frigates must train and familiarize themselves with this battlefield environment.

Chinese Hydrographic Research Vessels Near Yonaguni and Taiwan

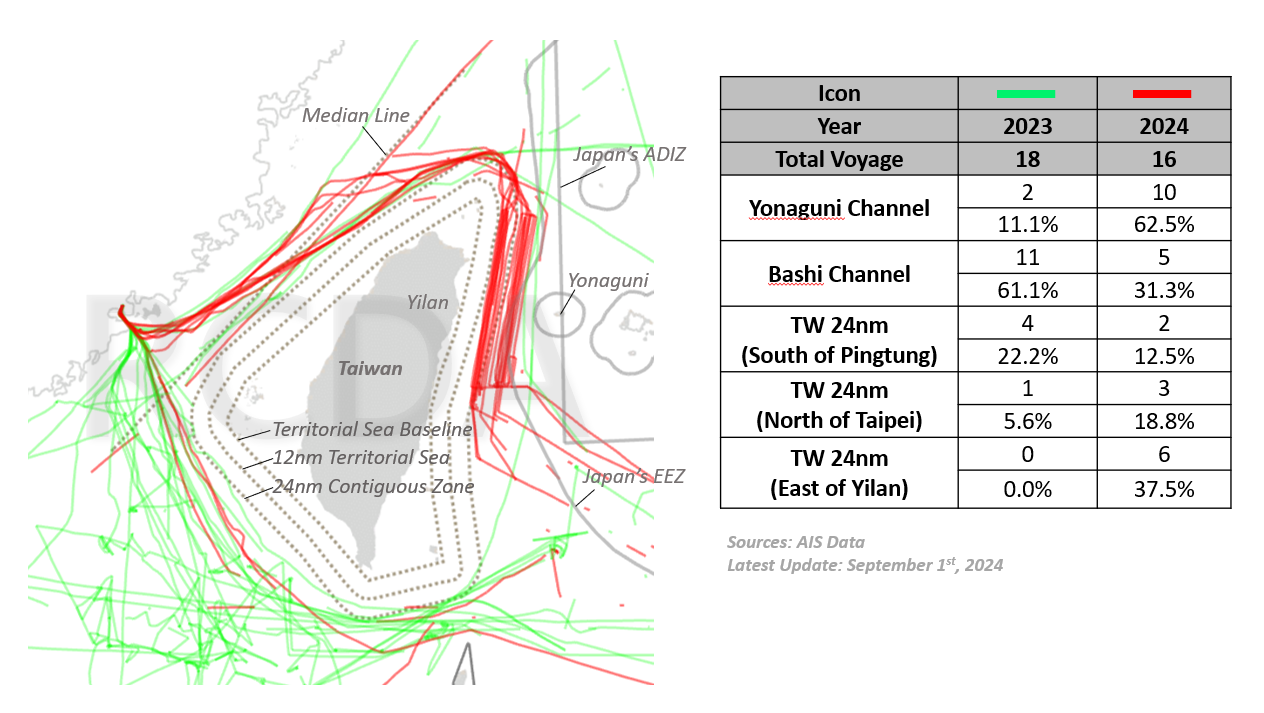

The second trend involves the activity of Chinese hydrographic research vessels passing west of Yonaguni, specifically in the Yonaguni Channel. The number of Chinese research vessels navigating the waters off the coast of Taiwan’s Yilan in 2024 has noticeably increased compared to 2023. According to AIS data publicly available and analyzed by RCDA, a comparison of the movements of Chinese hydrological survey vessels around Taiwan between 2023 and 2024 (up to August 31 this year) reveals four distinct trends in their activity in the vicinity of Taiwan.

First, there has been an increase in the activity of Chinese hydrological survey vessels. In 2023, there were a total of 18 AIS-recorded passages of these vessels around Taiwan throughout the entire year. In contrast, from January to August 2024, there have already been 16 such passages recorded, nearly matching the total for 2023.

Second, the focus of Chinese hydrological survey vessel activities has shifted from the southern waters of Taiwan to the eastern waters. In the vicinity of the Bashi Channel, there were 11 recorded passages in 2023, accounting for 61.1 percent of the total. In contrast, as of 2024, there have been five passages, representing 31.3 percent of the total. Meanwhile, in the Yonaguni Channel, there were only two passages in 2023, making up 11.1 percent of the total, whereas in 2024, this number has increased significantly to 10 passages, accounting for 62.5 percent of the total.

Third, Chinese hydrological survey vessels are gradually approaching closer to Taiwan’s coastline. In 2023, there were five instances of these vessels entering Taiwan’s 24-nautical-mile contiguous zone, accounting for 27.8 percent of the total. In 2024, this number increased to 11 instances, representing 68.8 percent of the total. Notably, six out of these 11 instances occurred in the Yonaguni Channel.

Fourth, in 2024, Chinese hydrological survey vessels exhibited the “Lawnmower Pattern” in the waters between Taiwan and Japan’s Yonaguni Island on three separate occasions. This pattern indicates that these voyages were conducted with the intention of meticulously surveying the hydrological conditions in this area.

Source: Compiled by RCDA based on AIS data.

More Anti-submarine Activity South of Yonaguni

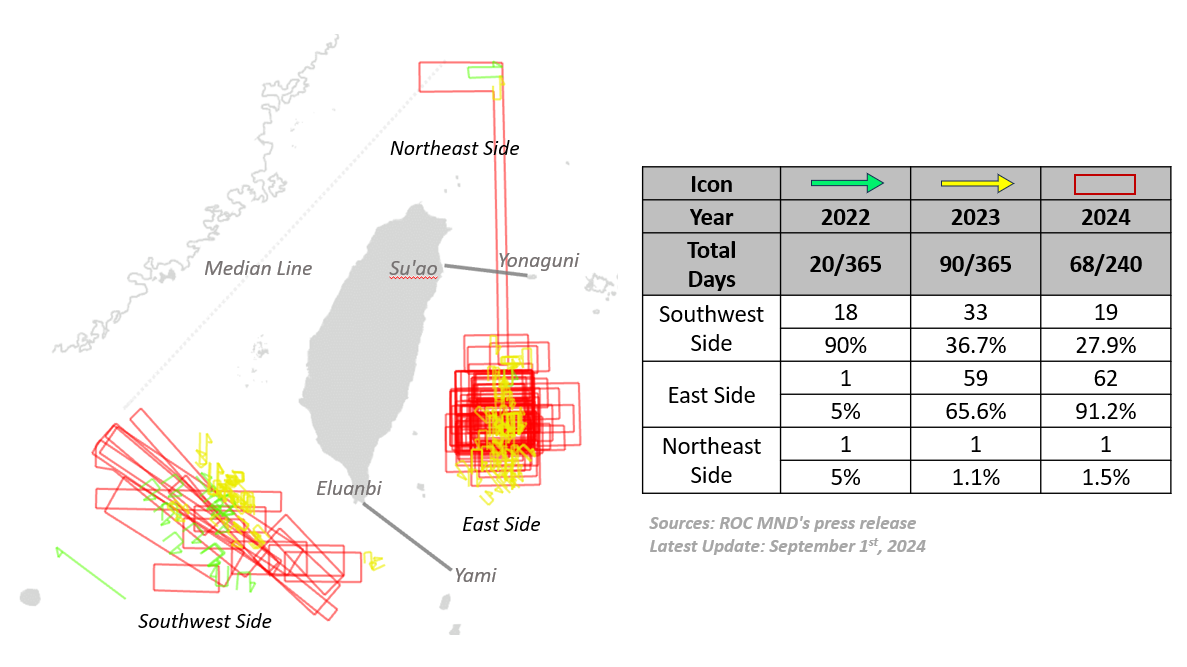

The third trend concerns the waters south of Yonaguni Island, where Chinese ship-based anti-submarine helicopters have increased their activities. According to data released by the Ministry of National Defense of the Republic of China (Taiwan), the PLAN’s ship-based anti-submarine helicopters have been operating more frequently to the east of Taiwan this year compared to previous years. In 2023, there were a total of 90 sorties, while from January to August of this year, there have already been 68 sorties.

In the southwestern airspace of Taiwan (west of the southernmost tip of Taiwan’s Eluanbi and the northernmost Philippine island of Yami), there were 33 sorties in 2023, accounting for 36.7 percent of the total, whereas in 2024, there have been 19 sorties, representing 27.9 percent of the total.

In the eastern waters of Taiwan (east of the southwestern airspace and south of Taiwan’s Su’ao and Japan’s Yonaguni Island), there were 59 sorties in 2023, making up 65.6 percent of the total. This number has increased to 62 sorties in 2024, representing 91.2 percent of the total.

Source: Compiled by RCDA based on press releases from the Ministry of National Defense of the Republic of China.

Combining observations of this trend with the activity of Chinese hydrological survey vessels, it is evident that China is enhancing its anti-submarine capabilities around Yonaguni Island, both in terms of collecting hydrological data and operating naval anti-submarine assets. A possible reason for this increased activity is the potential for the PLAN’s conventional-powered submarines, deployed from Daishan Island and Xiangshan in Ningbo, Zhejiang Province, to intensify their operations in this area.

Integrating the three trends mentioned above, another significant potential objective is that Chinese aircraft carriers may more frequently navigate the waters east of Yonaguni Island or through the Yonaguni Channel in the future. Aircraft carriers and their accompanying naval formations are crucial strategic assets. In addition to relying on the fleet itself for air defense and anti-ship capabilities, the anti-submarine capabilities of surface ships and submarines are equally vital.

The aircraft carriers operating near Japan, typically based in Guchengkou, Qingdao, Shandong Province, are accompanied by nuclear-powered submarines, which are primarily stationed in Shazikou, Qingdao, Shandong. Therefore, strengthening hydrological surveys and anti-submarine warfare operations in the waters around Yonaguni Island is essential for the PLAN’s aircraft carriers and nuclear-powered submarines. This is to avoid being tracked by foreign submarines due to insufficient familiarity with the area.

Policy Implications

These trends raise several policy implications not only for Japan but also for the United States and Taiwan.

First, Chinese submarines and aircraft carrier groups may aim to further evade the U.S. and Japanese underwater surveillance networks along the First Island Chain in order to access the Western Pacific.

Reports indicate that the U.S. and Japan have established an underwater monitoring system beneath Japan’s southwestern island chain, but there have been no credible reports in the Yonaguni Channel. Given that this area is under the jurisdiction of two countries (Taiwan and Japan) without a formal military alliance, coordinating the establishment of a long-term military underwater surveillance system may be challenging.

Consequently, the PLAN may seek to exploit this gap, avoiding areas along the First Island Chain where U.S. and Japanese anti-submarine capabilities are relatively strong, thereby increasing the probability of submarines entering the Western Pacific undetected and untracked. To this end, China has intensified its hydrological survey efforts in eastern Taiwan and the Yonaguni Channel, increased the frequency of PLA ship-based anti-submarine helicopter operations, and further strengthened its operational familiarity with the area.

Second, the new operational trends of the PLAN pose a greater attritional threat to the ROC Navy. The Yonaguni Channel is near Su’ao Port, a critical base for Taiwan’s navy, home to its largest destroyers, the Keelung-class (Kidd-class), and the oldest frigates, the Chi Yang-class (Knox-class). This means that, aside from special naval deployments, it will primarily be the Keelung-class or Chi Yang-class vessels that respond to PLAN ships passing through the Yonaguni Channel. An increase in PLAN activities implies a higher operational frequency for these two types of vessels.

It is important to note that each deployment of the nearly 10,000-ton Keelung-class destroyers incurs significant costs, while maintaining the aging Chi Yang-class frigates is challenging and costly. Therefore, the PLAN’s intensified attrition strategy in this area may have a more pronounced impact compared to similar operations in other regions around Taiwan.

Third, in contrast to the situation faced by the ROC Navy, Japan’s primary naval base in the southwestern islands is located in Naha, Okinawa, which is farther from the Yonaguni Channel than the PLAN’s base in Sandu’ao, Fujian. This means that if the Japan Maritime Self-Defense Force were to continuously respond to the increasing presence of PLAN vessels in the Yonaguni Channel, the challenges of Japanese ship deployment and the cost of logistical support could be considerably higher than China’s.

While global attention is focused on Chinese aircraft carriers operating closer to Japan, it is essential to closely monitor the significant changes in broader PLAN activities around Japan’s southwestern islands and eastern Taiwan. At the same time, the navies of Taiwan and Japan may need to establish a more extensive coordination mechanism to increase their presence in the Yonaguni Channel without conflict, thereby responding more effectively to China’s naval activities in this area and exerting pressure on the PLAN as it transits through these waters.